Crop Insurance 101: Prevented Planting Coverage Explained

What is Prevented Planting?

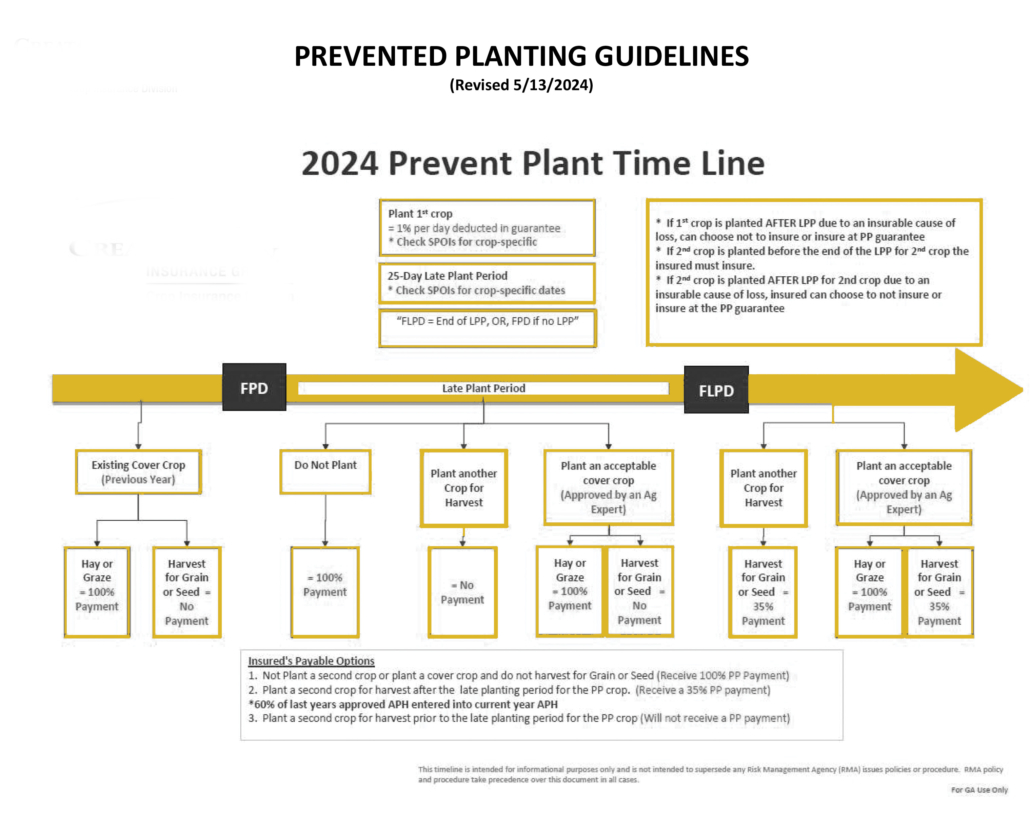

Prevented Planting refers to the inability to plant an insured crop by the Final Planting Date (FPD) or within the Late Planting Period due to an insured cause of loss. This cause must be general to the surrounding area and must prevent other producers with similar acreage characteristics from planting. Reasons such as lack of proper equipment or labor, or using a specific production method, do not qualify as prevented planting.

Steps to Take and What to Expect in a Prevented Planting Situation

- Submit a Notice of Loss: You must submit a notice within 72 hours after deciding not to plant due to an insurable cause of loss.

- Provide Documentation: Be prepared to present weather records or other documentation that demonstrate the insurable cause of loss.

- Field Visit by Adjuster: An adjuster will visit the field to document conditions and gather necessary information to determine payment eligibility.

- Acreage Report: Ensure that the prevented planting acres are reported on the Acreage Report.

- Eligibility Requirements: The eligibility requirements, conditions, and exclusions contained in the policy’s Basic Provisions must be met to qualify for a payment.

Second Crop Options When Prevented Planting is Claimed

You have three main options regarding second crops:

- Do Not Plant a Second Crop:

- Receive a Prevented Planting (PP) Payment equal to the guarantee multiplied by the crop’s PP coverage level percentage (e.g., 55% for corn).

- Plant a Second Crop After the Late Plant Period:

- Receive 35% of the PP Payment and pay 35% of the premium.

- If the second crop is insurable, it must be insured, and 100% of the second crop premium is due.

- The Actual Production History (APH) for the prevented crop’s acres will receive 60% of the approved yield.

- Plant an Acceptable Cover Crop:

- Impacts to the PP payment vary based on when the cover crop is planted and its disposition.

- A cover crop must be recognized by agricultural experts as agronomically sound for the area, intended for erosion control, conservation, or soil improvement.

- In some cases, a cover crop might be considered a second crop.

Important Considerations

- Disqualification: Planting a second crop before the end of the Late Planting Period for the prevented crop disqualifies payment on those acres unless it’s a cover crop or double-cropping qualifications are met.

- Cover Crop Details: The treatment of a cover crop and its impact on the PP payment depends on when it is planted and what happens to the crop (e.g., whether it is harvested or just used for soil improvement).

Summary

Prevented Planting provides financial protection when you are unable to plant due to insurable causes like adverse weather conditions. By following the required steps, providing necessary documentation, and understanding your options regarding second crops, you can manage your risk effectively and ensure compliance with the insurance policy provisions.

To learn more about the insurance products available for farm risk management, reach out to Chelsea Heatherington at Kingsgate Insurance.

Chelsea Heatherington, Farm & Ag Specialist

Call or Text: 515-302-8400

Email: chelsea@kingsgateins.com

Leave a Reply

Want to join the discussion?Feel free to contribute!